Category Archives: Renewable Energy Policy

Trends in new capacity development in China

China Energy Policy Newsletter – February 2020

Four snapshots on RE in China 2018

China RE power 2005-2017 in five pictures

See how renewable energy has developed in China since 2005.

[infogram id=”china-re-power-development-2005-2017-1h0n25ddy0x96pe”]

Renewable energy enables an early peak of CO2 emissions in China

China Renewable Energy Outlook shows pathways to a more sustainable energy future

China can reach its energy and environmental goals, but further policy measures are required for comprehensive energy transition to a sustainable low-carbon system. This is a main conclusion in the China Renewable Energy Outlook 2016, a new comprehensive study launched at the International Energy Transition Forum in Suzhou Monday 31 October 2016

“China needs energy for its further economic development but if we continue to rely heavily on coal, we will be stuck with an energy system, which pollutes, depletes our resources and confines us to the old industrial world”. Wang Zhongying, Vice Director General in ERI, director for China National Renewable Energy Centre and responsible for the China Renewable Energy Outlook, is serious about the problems created by the current energy system, but also optimistic about the future possibilities. “In tandem with the new industry revolution we must create a new energy revolution. Our analyses in the outlook show that renewable energy is ready to take the role as the back bone of the system within the next 15 years. A high share of renewables in the energy system in 2030 will not only reduce coal consumption and CO2 emissions substantially but also create a pathway towards a long-term low-carbon energy system”.

China Renewable Energy Outlook 2016 is the first renewable energy outlook from China Renewable Energy Centre (CNREC), a think tank within Energy Research Institute under NDRC. The Outlook analyses two scenarios for the future development of the Chinese energy system towards 2030.

The “Stated Policy Scenario” shows the impact of the current energy policy in China and the “High Renewable Energy Penetration Scenario” analyses the possibility of going even further with the deployment of renewable energy. In the Stated Policy Scenario, wind power capacity soars from 130 GW today to 500 GW in 2030 and solar PV develops from 43 GW to 500 GW. As a result, coal consumption decreases and CO2 emissions stabilise ca 2025.

The High Renewable Energy Penetration Scenario has 1000 GW wind power and 1100 GW solar PV in 2030. Here CO2 emissions decrease from today’s level peaking before 2020 and in 2030 the emissions are reduced by 12% compared with today. Coal consumption is reduced by 28% compared with consumption today. The analyses show that it is possible to integrate large shares of renewable energy into the Chinese energy system if the right policy measures are implemented. An efficient power market, with transparent electricity prices, is the single most important driver for cost efficient integration of renewable energy. At the same time coal power will find a new role as providers of flexibility in a system where renewable energy takes over the role of back-bone of the power supply.

China Renewable Energy Outlook has been developed as part of the larger program for boosting renewable energy in China, supported by the Children’s Investment Fund Foundation and the Danish Government.

In Suzhou the Danish Deputy Permanent Secretary at the Danish Ministry of Energy, Utilities and Climate highlighted the importance of comprehensive studies like the China Renewable Energy Outlook. “The Outlook clearly shows the importance of flexibility in the power system. The Danish experiences show that coal fired power plants can be operated very flexibly and we are able to integrate very large amount of wind power, thanks to flexible power plants, efficient power markets and flexible use of the electric interconnectors”.

China Renewable Energy Outlook 2016 is the first issue from CNREC. After the launch in Suzhou the work on next year’s outlook begins together with the US based National Renewable Energy Laboratory, the Danish Energy Agency, and the new German partners GIZ, Agora Energiewende and DENA.

China Renewable Energy Outlook 2016 is available for download on CNREC’s website or you can download it here

Green power dispatch in China – here is how to do it!

“China will promote green power dispatch, giving priority, in distribution and dispatching, to renewable power generation and fossil fuel power generation of higher efficiency and lower emission levels”.

These are the words in the U.S.-China Joint Presidential Statement on Climate Change that was released during President Xi’s visit at the White House on 25 September. And this is good news for integration of renewable energy in China. The curtailment of wind and solar power is a big problem for the further development of renewable energy, a waste of money for the society, and it creates local and global pollution, which could have been avoided.

However, the implementation of the priority dispatch is crucial for the success. It is not sufficient just to give orders to the Chinese dispatch centres to give priority to renewable energy (RE); it will only put the dispatch operator in an situation, where they have conflicting goals to fulfil without any real change to implement an efficient dispatch. Instead, a number of measures should be taken into play to ensure that all stakeholders pull in the same direction.

In my mind a coordinated action plan is necessary to ensure a proper green power dispatch. Here is my take on the elements in such a plan:

1. Stop for new coal fired power plat from 2020 and slow the pace before that

Firstly it should be clear, that there is not need for new coal fired power plant in the long run if China wants to have a sustainable energy system. Already today too many new coal-fired power plants are being build. The slow-down in electricity consumption growth is not a temporary issue – it’s also part of the long-term transition of the Chinese industry from heavy industry to light industry and services. And still coal fired power plants are being build at the same pace as before, resulting in significantly lower utilisation of the capacity, but also putting pressure on the use of power from renewables. So latest by 2020 new coal fired power plants should be banned. It should be decided now in order to give the industry sufficient time to change direction, and a strong cap for new coal power plants should be in place soon in order to slow down the pace until the full-stop in 2020.

2. Remove the priority dispatch for power plants

Today, in many provinces the coal fired power plants have a de facto priority in the dispatch by having the right to produce a certain amount of hours each year, the so-called “planned full-load hours”. These full-load hours are strong guidelines for the dispatch operators in the daily dispatch and by the end of the year the planned full-load hours should be fulfilled for each power plant. The rights were introduced to ensure the economic viability of the investments in new power plants in a situation where there were a strong need for new capacity due to soaring power consumption. Today, these rights gives a strong disincentive for integrating renewables and strong disincentives for the coal power plants to operate in a flexible way. Therefore the rights should be removed, and it seems reasonable to start with the old power plants which should have been able to have a reasonable pay-back time. It could be for power plants build before 2000.

For the power plants build after 2000 it might be difficult in one step to remove the right to produced a certain amount of hours for economic reasons. But the physical right to produce could be substituted by e.g. tradable production rights, which could allow for others, including new wind farms and solar power plants to have access to the dispatch. But of course other compensation mechanisms could be used instead, and most importantly, the compensation should be reduced gradually.

3. Loosen the ties between heat and power production

Combined production of heat and power is an efficient way to utilise the fuel, but when the power production from coal fired combined heat and power plants (CHP-plants) substitutes power from wind and solar, it’s less efficient, more polluting and more expensive than letting heat-only boilers cover the heat demand. Therefore, loosen the ties between heat and power production when there is sufficient power production from renewables to cover the consumption. Large heat storages at the CHP-plants will allow for more flexibility, and they can also be used to convert electricity to heat, if the production from variable power production is bigger than the consumption. But it should also be allowed to use efficient heat-only boilers, it should be encouraged to introduce large solar heating plants as part of the heating system etc. Flexibility is the keyword here.

4. Make the grid work for integration of variable power production

Today the dispatch of the interconnectors between provinces and between power regions are not very flexible, which is a major barrier for RE-integration. Therefore, flexible use of the existing transmission grid is a precondition for a priority dispatch of RE. The exchange of power from one province to another should be part of the daily dispatch, not determined by long-term, inflexible agreements and settlements.

Furthermore, a plan for a rapid and strong expansion of the regional interconnectors should be set-up, based on systematic assessment of the potentials for deployment of RE power production. This would ensure a much better use of the variable power production through the “smoothing effect” of larger system areas and the better relation between power production and power demand in larger regions.

Finally, it is necessary to re-evaluate the strategy for long-distance high-voltage transmission lines. Currently these lines are primarily designed for base-load operation, which creates in-flexibility both in the supply end and the receiver end of the lines. Also the long-distance transmission lines should be dispatched according to the daily needs for matching production and consumption on an sub-hourly basis.

5. Encourage demand side flexibility and promote storage technologies

The variability of the power production from wind and solar is a challenge for the integration of RE, which in the short run can be solved by the above mentioned measures. However, a more flexible use of electricity and introduction of electric storage will in the long run be part of the solution. Therefore, economic incentives for flexible use of electricity should be introduced; plans for rapid development and deployment of electric vehicles should be prepared – with incentives for flexible charging; and R&D support for long-term development of electric storage should be encouraged.

6. Introduce a national-wide power market as tool for green power dispatch

Introduction of a Chinese power market is the last of my bullet point. Not because it is the least important measure, on the contrary; a well-design power market would be the right tool to ensure the implementation of the other measures. A dynamic price-setting of power production would create economic incentives for the power generators to operate their power plants in a flexible way; it would give incentives to flexible use of electricity; and it would take care of the daily dispatch based on least-cost principles. Combined with a carbon tax (or by an efficient implementation of a carbon emission trading system) it would be sufficient to create a green dispatch. One the other hand it is clearly a long-time project to create an efficient national-wide power market, while most of the other measures could be implemented immediately or in a shorter time horizon, so there is no reason to wait for power market to start getting greener in the dispatch.

See more about renewable energy in China on boostre.cnrec.org.cn

Lessons learnt from the European power system transformation

Europe is these years’ test laboratory for the future power system, and Europe’s “new normal” will also become the Chinese power sector’s “new normal” in the future. Here are some early take-aways from the European energy transformation.

In the beginning of July the Danish wind power plants produced a record high 140% of the electricity consumption in Denmark two nights in a row and then dropped to almost zero within a half day without any disturbance in the power system. Similarily, on the morning of March 20th, the German grid operators managed to deal with the rapid fluctuations of 39,000 MW of solar PV during the solar eclipse.

These two examples illustrate that the future European electricity system will be completely different from the electricity system during the last century, which was mainly based on fossil fueled and nuclear power plants. The future, European energy system will have variable energy production from wind and solar as the backbone and the remaining thermal power plants (fossil or nuclear fueled) will adapt to the variation in the load as well as the variation in the production from solar and wind. According to a recent, European study from Agora Energiewende, it is claimed that in 2040 there will be no base-load power unit left in Europe (base-load units produce with full capacity day and night for a longer period, typically with around 6000 or more hours with full-load during a year’s 8760 hours).

How will this be possible without jeopardizing the security of supply? The keyword here is “flexibility”. Flexible power plants, flexible dispatch of transmission lines and flexibility in the demand will do the trick, which has already been demonstrated by the European experiences. Maybe in the future electricity storage would be an additional tool in the flexibility toolbox, but the European experiences indicate that it is possible to cope with large amount of variable power without expensive storage.

China also wants a deep transformation of the energy system – a Chinese “energy revolution” – with a higher percentage of renewable energy. So what could China learn from the European experiences?

In my opinion there are four main lessons from the energy transition in Europe:

1. Fossil fueled power plant can be very flexible.

In Denmark coal-fired power can operate down to 10% of installed capacity, they can change their production up and down very quickly and they can start up fast. The power plants were not as such born with good characteristics regarding flexibility; they have been developed by a thorough trial-and-improve process. The main achievements have been reached by training and changed in the control centre of the power plant – not by massive new investments.

The Chinese coal fired power plant are very similar to the Danish power plants, most of them are even newer, therefore technical problems in creating the same flexibility for the Chinese power plants will not be likely.

2. An efficient power market with hourly prices is necessary to create flexibility in the power system.

The owner of a power plant would only consider flexible operation if it is beneficial for him/her, either by recieving a reward for flexibility or being punished for inflexible operation. The European market system with hourly prices, depending on the supply and the demand, clearly gives incentives for producing when the price is high (lower production and/or high demand) and to stop producing when the price is low (increased production and/or low demand). If your power plant is inflexible you will soon start loosing money because your costs often will be higher than the price that you recieve for the electricity produced. Some European power markets even require you to pay to get rid of your production, if the supply is higher than the demand.

In China the power producers have no incentives for being flexible. On the contrary they will loose money and market shares if they try to run the power plants by flexible standards. This is one of the most significant obstacles for integration of wind and solar, and it explains to a large extent why China is in the habit of curtailing wind power production, while this is very rare in Europe. Luckily, the Chinese government is pushing for a revival of the power market reform, which hopefully will create the necessary incentives for flexibility.

3. The transmission system must be large and flexible.

The European experiences clearly shows that the large transmission systems are very efficient in integrating variable energy. Transmission systems allow for reducing the variability of wind and solar by integrating larger areas – this is often called the “smoothening effect”, because the wind speed and the solar radiation is not often the same all over Europe. But it requires that the transmission system is operated in a flexible way. If the dispatch of a transmission line is fixed, e.g. on a monthly basis, it is of no use in the wind and solar power production, which is typically predictable from day to day and often will deviate from the forecast within the day of operation.

In China the transmission system has been developed rapidly during the last ten years, and a large number of long-distance, high-voltage transmission lines are being build or are in the planning stage. However, the transmission lines are not being dispatched in a flexible manner and the long-distance lines are typically planed to be base-load supply to the load centres. This is a huge obstacle for harvesting the benefits from renewable energy by efficient integration of the variable production. Also the Chinese transmission lines should be part of the future Chinese power market and operated according to the price signals from the market.

4. The changing mindset in the power sector.

The last two decades have not been easy for the typical old-school power sector CEO. He was used to lead a large monopoly company, which basically could decide on its own how and when to establish new power generation; it’s customers could not change to another company, and no competitors were allowed to have access to the grid. Today it is totally different. The coal fired power plants are threatened by renewable energy, the customers can choose other suppliers or even choose to produce by themselves with distributed generation and the transmission grid are owned and operated by independent system operators looking at the society as a whole and not only on the profit of the generators. The best of the old power producers have adapted to the new situation – maybe slowly, but nevertheless, they are now ready to be a part of the future power sector. Others are still stuck in the old-school thinking and they will experience even harder times in the future and have a difficulty surviving in the not-so-long run.

The Chinese, energy transformation has only recently begun and most of the power sector’s mindset is still turned on to the existing “normal” with coal power as the backbone of the power system. But also in China the “new normal” will be a much more flexible power system with renewable energy in a dominant role. The lessons from Europe are that the most agile companies are the survivors, because they are able to foresee and adapt to the future framework conditions and will not risk being stuck in the old-school “normal”.

This blog was first published at boostre.cnrec.org.cn.

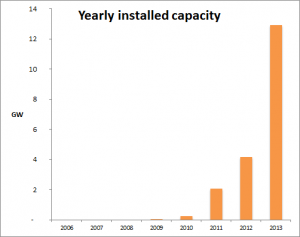

Will China reach it’s 2014 targets on Solar PV?

3,3 GW new installed capacity in the first half year of 2014 is indeed impressive for the Chinese solar PV development, but it is quite far from the 14 GW the National Energy Administration (NEA) announced as target for 2014 in the beginning of the year.

The installed capacity in the first half of 2014 might not be alarmingly low. In 2013, where the total new installed capacity reached 13 GW, the main installations happened in the second half of the year. The newly released figures for 2014 might however have given NEA reason to reassess the 2014 targets. Several sources cite the head of NEA, Wu Xinxiong, for new 2014 targets: PV-Tech.org says the new target is 13 GW, mainly from distributed PV, while the July Briefing paper from AECEA cite Wu Xinxiong for a target as low as 10 GW. AECEAs own estimation is however more in line with the 13 GW that PV-Tech.org quote.

The main difference between 2013 and 2014 is that NEA now has high priority to distributed PV installations. In 2013 only 1 GW of the total 13 GW new installed capacity was distributed PV capacity, while 12 GW was utility based solar power plants. The targets for 2014 from the beginning of the year were 8 GW distributed PV capacity and 6 GW utility based capacity. The figures for first half of 2014 shows 1 GW distributed capacity and 2.3 GW utility based capacity.

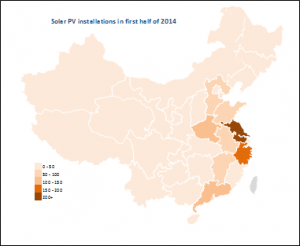

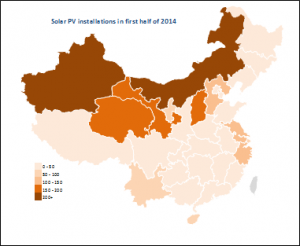

The regional distribution of the new installed capacity for first half of 2014 is clear: The solar power plants are installed in the North and North West China, with Xinjiang in the top with 900 MW, while the distributed capacity is installed in East and South China.

China RE Policy research – full speed forward

China RE Policy research – full speed forward

The impressive list of 2013 activities in China National Renewable Energy Centre illustrates the centre’s importance for setting the scene for Chinas future energy system.

CNRECs 2013 annual report is an impressive story about a large number of projects carried out by the team behind the centre. All projects very topically, focusing on policy research and aiming at giving the Chinese policy makers the best available basis for decisions.

CNREC was launched in early 2012 and the centre has since shown it’s value for the deployment of renewable energy in China. The centre’s activities comprise policy research, RE industry development, management of large demonstration programs, development of monitoring systems and databases for information about RE development in China and abroad, and last but not least boosting cooperation between China and the international RE community.

Have a look – download the easy-read report here.