Category Archives: Wind energy

Trends in new capacity development in China

Four snapshots on RE in China 2018

China RE power 2005-2017 in five pictures

See how renewable energy has developed in China since 2005.

[infogram id=”china-re-power-development-2005-2017-1h0n25ddy0x96pe”]

Renewable energy enables an early peak of CO2 emissions in China

China Renewable Energy Outlook shows pathways to a more sustainable energy future

China can reach its energy and environmental goals, but further policy measures are required for comprehensive energy transition to a sustainable low-carbon system. This is a main conclusion in the China Renewable Energy Outlook 2016, a new comprehensive study launched at the International Energy Transition Forum in Suzhou Monday 31 October 2016

“China needs energy for its further economic development but if we continue to rely heavily on coal, we will be stuck with an energy system, which pollutes, depletes our resources and confines us to the old industrial world”. Wang Zhongying, Vice Director General in ERI, director for China National Renewable Energy Centre and responsible for the China Renewable Energy Outlook, is serious about the problems created by the current energy system, but also optimistic about the future possibilities. “In tandem with the new industry revolution we must create a new energy revolution. Our analyses in the outlook show that renewable energy is ready to take the role as the back bone of the system within the next 15 years. A high share of renewables in the energy system in 2030 will not only reduce coal consumption and CO2 emissions substantially but also create a pathway towards a long-term low-carbon energy system”.

China Renewable Energy Outlook 2016 is the first renewable energy outlook from China Renewable Energy Centre (CNREC), a think tank within Energy Research Institute under NDRC. The Outlook analyses two scenarios for the future development of the Chinese energy system towards 2030.

The “Stated Policy Scenario” shows the impact of the current energy policy in China and the “High Renewable Energy Penetration Scenario” analyses the possibility of going even further with the deployment of renewable energy. In the Stated Policy Scenario, wind power capacity soars from 130 GW today to 500 GW in 2030 and solar PV develops from 43 GW to 500 GW. As a result, coal consumption decreases and CO2 emissions stabilise ca 2025.

The High Renewable Energy Penetration Scenario has 1000 GW wind power and 1100 GW solar PV in 2030. Here CO2 emissions decrease from today’s level peaking before 2020 and in 2030 the emissions are reduced by 12% compared with today. Coal consumption is reduced by 28% compared with consumption today. The analyses show that it is possible to integrate large shares of renewable energy into the Chinese energy system if the right policy measures are implemented. An efficient power market, with transparent electricity prices, is the single most important driver for cost efficient integration of renewable energy. At the same time coal power will find a new role as providers of flexibility in a system where renewable energy takes over the role of back-bone of the power supply.

China Renewable Energy Outlook has been developed as part of the larger program for boosting renewable energy in China, supported by the Children’s Investment Fund Foundation and the Danish Government.

In Suzhou the Danish Deputy Permanent Secretary at the Danish Ministry of Energy, Utilities and Climate highlighted the importance of comprehensive studies like the China Renewable Energy Outlook. “The Outlook clearly shows the importance of flexibility in the power system. The Danish experiences show that coal fired power plants can be operated very flexibly and we are able to integrate very large amount of wind power, thanks to flexible power plants, efficient power markets and flexible use of the electric interconnectors”.

China Renewable Energy Outlook 2016 is the first issue from CNREC. After the launch in Suzhou the work on next year’s outlook begins together with the US based National Renewable Energy Laboratory, the Danish Energy Agency, and the new German partners GIZ, Agora Energiewende and DENA.

China Renewable Energy Outlook 2016 is available for download on CNREC’s website or you can download it here

China wind power development back on track, but…..

The latest market report from GWEC is encouraging reading for the Chinese wind industry, but the main challenges for the future development are still not solved.

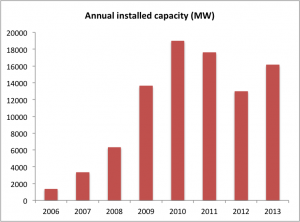

The new Global Wind Statistics 2013 from Global Wind Energy Council shows a global recession in the wind power development with the Chinese market as a remarkable exception. After two years with lower new installed capacity than the previous year, 2013 gave 16 GW new capacity in China, now reaching a total installed capacity of 91.4 GW wind power.

The un-official NEA target for 2013 was 18 GW and this is probably the level of new capacity NEA would like to see for the years to come for on-shore turbines. The peak in installed capacity was in 2010 with almost 19 GW, while 2011 and 2012 showed a decrease (17.5 GW and 12.9 GW).

For the Chinese wind industry this is good news. The Chinese wind manufacturers are totally depended on the Chinese market – only the biggest companies have succeeded in global activities on a small scale – and the last couple of years have been a nightmare for a number of companies with Sinovel as the most known. And a level of around 18 GW annually would give new wind to at least the biggest and most competitive companies.

But the crisis in the Chinese wind industry is probably not finished yet for several reasons.

Firstly, the main barriers for integration of wind power into the Chinese energy system have not be removed. In average more than 20% of the potential wind power production is curtailed on a yearly basis, and some wind farms experience more than 40% of the yearly production is curtailed. Needless to say that this is jeopardizing the economy of the wind farm projects if this continue. The integration issue is first and foremost a question about the right incentives for the thermal power plants to be more flexible – the cure is quite clear, but such institutional changes require a strong hand from the whole government and coordinated effort from a number of different ministries.

Secondly the Chinese government aims to gradually reduce the size of the Feed-In-Tariff, which again puts strong requirements on the future development of the wind turbines to lower the total cost of energy – both the investment cost but not least improving the reliability and reducing the operational costs.

Thirdly the requirements from the grid to the wind turbines are increasingly strong. This is necessary in order to technically integrate a larger share of wind power and also in line with the global development, where wind turbines more and more is considered as “normal” power plants with requirements or delivering different types of services to the power system. This put even more pressure on the Chinese wind manufacturers to be innovative and deliver with high quality. On the other hand – if the Chinese manufacturers can deliver to the future Chinese market they will also be able to compete on the global market to the benefit of the global development and deployment of wind power.

So let us enjoy the revival of the Chinese wind power market in 2013, but let us hope the Chinese wind turbine manufacturers and the Chinese government will be able to act quickly on the current challenges. Failure to act will be a serious threat to the future for the Chinese wind power industry and for the global wind power development as such.

Danmark 2012: 30% wind power and no curtailment at all – how is it possible?

2012 was a new record year for wind power in Denmark. Last year the wind power production in Denmark amounted to 30% of the Danish electricity consumption, while in 2011 the figure was 28,2%. This is of course good news for the global environment but due to Denmark’s small size the biggest contribution to the global environment might not be the CO2 reduction itself but the Danish showcase: It is possible to have a high share of fluctuating electricity production in the energy system without curtailment at all. And 30% is only a step towards the even more ambitious target of 50% in 2020. Right now the next off-shore wind farm is being established in Denmark – see the pictures here. (The picture below is the Danish wind farm Middelgrunden near Copenhagen on a cloudy October day in 2012).

But what is the secret behind the large share of wind power, and what can China learn from Denmark?

A number of factors enables the high wind power penetration. Denmark has strong transmission lines to the neighbouring countries and access to hydro power storage in Norway. And a well functioning electricity market ensures optimal use of these interconnectors and the optimal combination of wind power and hydro power. The dynamic pricing of electricity created by the electricity market send price signals hour by hour to the producers and consumers. When the electricity production is high due to wind power and combined heat and power production (CHP), the electricity price is low; and when the wind power production is low (or zero) the price gets higher. This system also gives strong incentives for the power producers to make their thermal power plants more flexible. In facts, some of the coal fired power plants in Denmark can produce electricity and heat at a level of 10% of their maximum capacity. In China the requirements for minimum production is 50% of the max. capacity for the coal-fired power plants. All Danish CHP plants have also heat storage attached, which makes it easier to decouple heat and power production. When the electricity price is high, the CHP plants produces electricity and surplus heat can be stored in the heat storage, which basically is a large water tank. When the electricity price is low, the heat consumption is covered by the heat storage alone. And when the electricity price is very low, it can be beneficial to use electricity to warm up the water in the heat storage instead of running the thermal CHP plant. The combination of wind power, hydro power and thermal CHP plants with heat storage gives a very flexible system which is the physical explanation behind the high RE share in the Danish electricity supply.

To fully understand the Danish success of integrating wind power, you should also take into account the institutional and the “mental” framework for the electricity supply sector. In many countries – also in China – wind power is often regarded as an “add-on” to the “normal” electricity supply based on thermal power plants – fossil fuel or nuclear. The add-on RE power then is supposed to take care of its own problems, e.g. balancing the fluctuating production, and if it is not possible, then the easy solution is to curtail it, e.g. to stop the production from the wind farms, because the wind farm is causing the problem. But in Denmark, wind power is regarding as an integrated part of the electricity supply. Balancing problems is therefore a system problem, not a problem for the wind farms. This mental change in the perception of the electricity system is important for solving the integration challenges. Also the institutional set-up is important. Years ago the electricity sector was one integrated monopoly. Today the Danish grid operator (or Transmission System Operator – TSO) have been totally independent of the electricity producers for more than 12 years and it acts totally neutrally towards all power producers. Furthermore the large power producers in Denmark owns a large share of the wind power plants and integrate them into their portfolio of power plants in the daily operation. And by setting ambitious goals for the further development of RE power in Denmark (50% in 2020, 100% in 2050) the Danish government encourage both the TSO and the power producers to integrate RE in their planning process. The long term grid planning is thereby targeted at making these goal feasible, not only in Denmark but also in a European context, where the European TSO’s makes 10 years grid plans every second year.

And what are the lessons learned for China?

Firstly it is important to start considering RE power as part of the whole electricity system, not as an add-on to the thermal power system. Secondly it is urgent to setup economic incentives for flexibility for the power producers and for the use of local and regional transmission lines. Dynamic pricing is essential, but it is not necessary to introduce a complete market-setup to create this – a system with the system dispatch centres as vehicles for flexibility could be establish without a full market, like in Denmark where the electricity market evolved over a number of years, starting with more simple measures. When such economic incentives are in place, I am quite sure that the technical solution like flexible thermal power plant and heat storage at the CHP plants would develop rapidly.

Also an integrated planning process combining grid planning with planning for energy efficiency and energy supply would strengthen the integration of renewables, the development of smart grids and the use of the energy demand as part of the overall system flexibility. Maybe China could get inspiration from the European approach with the 10 year grid development plans and market studies with an even longer time horizon.

Of course China is China, and she has to develop her own solutions to the energy challenges. The Danish experiences and lessons in integration of RE can however support the analytic development of measures, methodologies and processes, which are necessary for the development of a sustainable energy system with a high share of RE in China. The Sino-Danish RED program is one example on how China and Denmark work together on such a development.

The biggest obstacle to wind power development in China

Curtailed wind power gives record loss for wind power producers in 2012. Recent estimates reveals that 20 TWh or between 20 and 30 percent of the total Chinese wind power production was curtailed in 2012, according to Qin Haiyan, secretary general of the Chinese Wind Energy Association as cited in Windpower Monthly. The curtailed electricity has the value of CNY 10 billion, and the producers have not been compensated for the loss. The curtailed electricity could lower the local and global pollution and for the society as a whole it would be cheaper to curtail the coal fired power plants instead of the wind farms. To put it simple: Curtailed wind power = more pollution + more costs + less incentives for new wind power.

The large amount of curtailed wind power is in my opinion the biggest obstacle for the Chinese government’s ambitious plan for wind power deployment. It is difficult for wind power developers to justify investments in new wind farms if you know that up to 40% of the annual production will not be sold. And if you are forced to establish new wind farms due to quota system or similar, you will tend to invest in cheap wind turbines with low efficiency, since high efficiency will be punished by even more curtailment.

So it is absolutely necessary to improve the situation for the wind farms quickly in order to get the benefits from wind power and encourage more investments.

Then what should be done? Well in principle the solution is straight forward: The electricity system must be more flexible and regard wind power (and solar PV) as an integrated part of the system – not as an add-on to the thermal system. Today the thermal power plants have no or few economic incentives for being flexible, since the income is almost solely depending on sale of electricity. Also the dispatch centres should have better possibilities and incentives for a more dynamic use of interconnectors to neighboring areas. When the economic incentives are in place the technical obstacles would soon disappear – all experiences from e.g. Europe show this.

In practice it might not be as simple. It is alway difficult to change the division of benefits and costs between different stakeholders and the thermal power plants would potential have difficulties in recovering investments if they have to cut down on the number of hour they can produce during the year. But if the Chinese government want to fulfill it’s ambitions on renewable energy, a solution must be found quickly. My guess is, that this issue is on top of the agenda for the NEA this year.

PS: The picture is from a large wind farm in the North West of Jilin, one of the provinces with most curtailment.

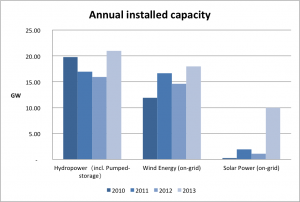

China 2012: Slowing down on RE deployment

Fresh figures from China’s State Electricity Regulatory Commission (SERC) shows stagnation in the 2012 deployment of renewable energy in China. According to SERC, 15 GW of hydro power, 13 GW of wind power and 1 GW of solar power were established in 2012. These figures are less than the similar figures for 2011 for all three technologies.

The stagnation in the annual new installed capacity of wind power and solar power underline the serious and deep crisis for the Chinese RE industry. Both the wind industry and the solar industry are suffering from lack of orders and huge mismatch between production capacity and market demand.

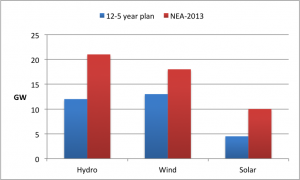

NEA’s recent announcement of ambitions for 2013 aims to break the trend and to reestablish old growth trends. As shown in the figure comparing the annual installed capacity in 2010, 2011 and 2012 with the NEA ambitions for 2013: More hydro, more wind, and 10 times more solar!

2013 to become a big year for RE in China

The National Energy Administration in China have high expectations for the development of renewable energy in China in 2013. The 12th 5 year plan for renewable energy, which was launched last year set the targets for 2015 for the various technologies at a fairly ambitious level; 260 GW hydro power, 100 GW grid connected wind power and 21 GW solar power should be installed by 2015. Compared to the 2011 level this gives average annual increases of 12 GW per year for hydro power, 13 GW per year for wind power and and 4.5 GW for solar power. But NEA now expect 21 GW hydro power, 18 GW wind power and 10 GW solar power to be installed in 2013 – all higher the the average yearly targets from the 12th 5 year plan.

So despite the current challenges for integration of renewables into the Chinese electricity grid, including lacking regulation and incentives for distributed solar power, NEA is quite optimistic or ambitious regarding the possibilities for deployment of RE in 2013.

Are the ambitions realistic? Well past experiences have shown that massive yearly deployment is possible, so it is difficult just to judge the 2013 targets as unrealistic. On the other hand the current challenges for integration and deployment cannot be easily delt with. Action is needed to avoid curtailment by making the electricity system much more flexible. And the deployment of solar power requires focus on large scale deployment of small scale solar power systems, roof-top and building integrated systems. And the barieres for such system might be underestimated when the 2013 targets were set. However, the signals from NEA is very encouraging: RE must have a bigger role in the Chinese energy supply in the future, and with these ambitions it is sure that a lot of effort will be made to quickly remore the barriers for deployment and integration of RE.

(Let me add that the figures might not be as easy to compare that shown. The figures for the 12th 5 year plan are grid-connected capacity, which for wind power make a big difference from the total installed capacity. It is not clear if the NEA 2013 figures also are grid-connected capacity or total installed capacity)

The minutes from the NEA working meeting where the targets were set, can be found on the NEA web site. The meeting ended up with eight focus areas for NEA in 2013, including increased domestic energy supply, more renewable energy, control of the total energy consumption, preparation of an energy sector reform, enhanced international energy cooperation, more research and demonstration, electricity to people without electricity supply, and strengthen of the management of the energy sector. It looks like a quite busy year for the energy administration, also in 2013 :-).