This week the preparation of a comprehensive Chinese solar roadmap was launched in Beijing. The roadmap will look at solar PV, concentrated solar power (CSP) and solar thermal technologies and analyse the technology development trends, international and national market trends as well as the possibilities and challenges for the Chinese solar manufactures. The roadmap will be finalised by the end of 2013.

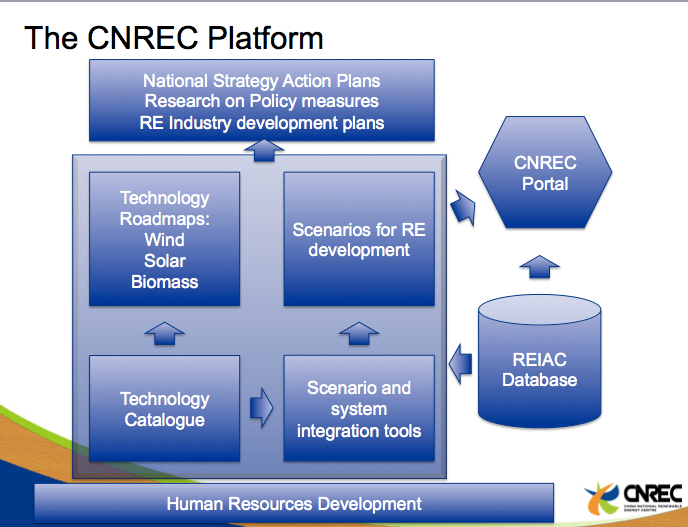

The Solar Roadmap is sponsored by the Sino-Danish Renewable Energy Development (RED) Program and it is supervised by the China National Renewable Energy Centre – CNREC. The analyses will be carried out by a large number of leading Chinese experts under the umbrella of China Renewable Energy Society supported by international solar experts participating in the IEA Solar Technology Initiatives.

At the kick-off meeting on 29 January 2013 I had the possibility to wrap up the plenum discussion with these words:

“We already have a number of international and national solar roadmap and it is of course very useful to learn from these experiences. But it is also important to realise that the Chinese roadmap should focus on the Chinese context. The solar market is a global market with China as one of the major players on the manufacturing side. Thus the roadmap should look into the international market development expectations. Also the technology development is international and international development trends are therefore important frameworks for the Chinese roadmap. But the Chinese roadmap must address the challenges and possibilities for solar in the Chinese energy system, and also address the short term an long term possibilities and challenges for the solar manufactures.

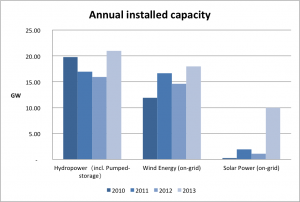

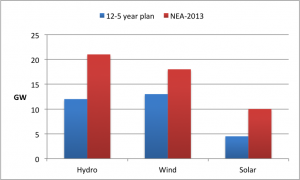

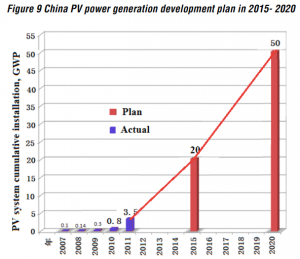

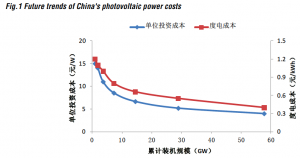

The Chinese ambitions on deployment of solar installations are very ambitious, especially on the PV installations. This month NEA announced a target of 10 GW of installed capacity for 2013, about 10 times the installation in 2012. For solar thermal, especially large scale systems, the potential might not have be fully understod yet. For both technologies this roadmap will be very important to clarify both the short term and long term challenges and possibilities and also to look into the different policy measures suitable for ensuring the deployment.

The Chinese RE industry is wisely considered as one of the strategic emerging industries in China, and the Chinese solar PV Industry has certainly shown its ability to move quickly. But today the PV industry is in trouble. Production capacity is much higher than the current market demand, and it is difficult to quickly adjust this capacity downwards again. This partly explains the urgent need to stimulate the national market, but even the 10 GW goal might not solve the problem for the PV-industry. At the same time the technology breakthrough of new systems might be just around the corner, which again will challenge the Chinese manufactures. Will they be able to become front runners in this development or will they be stuck with the old technology solutions? I think this roadmap will be particular important for the solar industry as a basis for understanding both the national and international market and as a tool for understanding the emerging technologies which are necessary to implement in the future in order to survive and grow. I hope the team will use the working process to frequent consult with the industry, both to get inspiration and input but also to provide and discuss the result with this very important stakeholder group.

Should the roadmap be consistent with the current national energy plans? Not necessarily! Road maps should point to possibilities and expand the knowledge of these technologies. Roadmaps are in my opinion front runners for energy plans. Then of course the energy plans might have other considerations which will deviate from the roadmaps and that is actually no problem to have these different perspectives. So I encourage you to be bold regarding potentials and possibilities including ambitious long time goals but also to be realistic regarding the challenges and needs for implementing measures.

I am very happy to see that the working team include the best Chinese solar experts. This is very promising for the quality and success of the roadmap. I am of course also happy that it has been possible to include the Danish experts in the work contributing with experiences from Europe and from the important work in the IEA technology groups.

I wish you good luck with this important and exciting study. I am looking forward to follow the work and to see the first roadmap by the end of this year”.